Mistakes in sales tax are more widespread than most businesses realize, in particular with businesses that work in more than one state or provide their goods via digital and online platforms. The positive aspect is that incumbent correction of inaccuracies could make huge savings in terms of penalties, interest, and audit exposure.

The following are the major questions that businesses would usually pose when ready to deal with past sales tax mistakes- and viable solutions to ensure they remain audit-compliant.

What Types of Sales Tax Errors Are Most Common?

The errors may be made in terms of their poor collection of sales tax, improper application of tax rates, not registering in nexus states, omissions of use tax responsibility, and poor management of exemption or resale certificates.

The problem with errors is that they usually come about due to altering of nexus rules, manual work, or quick business growth without updated tax controls.

How Can a Business Identify Past Sales Tax Errors?

The initial step is normally a voluntary internal sales tax review. This is the reconciliation of sales records, a review of taxability decisions of product or service, and reviewing whether the appropriate jurisdictions were reported.

When comparing point-of-sale information, invoices, and entries in the general ledger, one is likely to realize discrepancies that should be corrected. Experienced IRS tax experts (former IRS tax agents, former auditors, and experienced criminal tax attorneys) can help to find the errors and amend those.

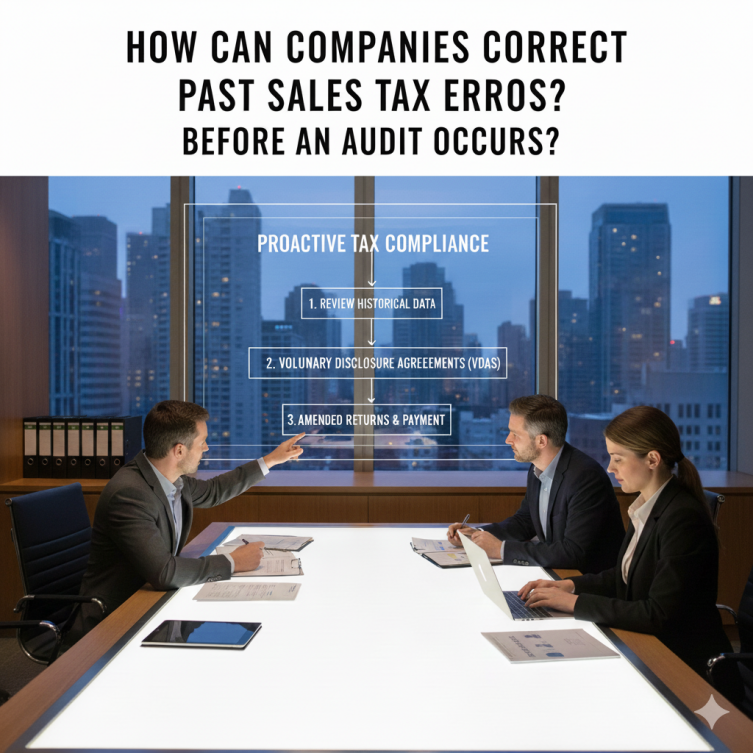

Should Errors Be Corrected Before Receiving an Audit Notice?

Yes. Annual correction of the errors prior to notice of audit usually leads to better treatment. Tax collectors tend to be less aggressive when the business initiative is made voluntarily. As soon as an audit is launched, the possibilities are limited, the punishments get worse, and leverage during a negotiation gets less.

What Is a Voluntary Disclosure Agreement (VDA), and When Should It Be Used?

Voluntary Disclosure Agreement is an act through which businesses can unknowingly reveal selling tax. VDAs frequently impose restrictions on the lookback period, minimize or remove penalties, and offer a systematic way to compliance. They come in handy, particularly where a business learns to have nexus exposure in states where it was never incorporated.

How Should a Business Correct Errors on Previously Filed Returns?

The majority of the states permit altered submissions to rectify past submissions. The businesses must compute the right amount of tax that must be paid, the interest in case, and give it supportive documents. Precision is paramount–filings once amended must be in line with records, with new red flags not being raised.

Can Businesses Negotiate Penalties and Interest on Past Errors?

In many cases, yes. In case the errors are caused by reasonable cause instead of willful neglect, the businesses can demand the penalty abatement. Evidence of good-faith compliance efforts, revised procedures, and immediate correction makes the argument in favor of lighter penalties stronger. The sales tax audit penalties can come with a lot of fines, and that can become problematic. Hence, right negation is important for the venture.

What Role Does Documentation Play in Correcting Sales Tax Mistakes?

There is a necessity for strong documentation. A business is supposed to keep transaction-level data, including exemption certificates, customer correspondence, and corrections. Clearness not only assists in the correction but also shows willingness to comply should an audit ensue in the future.